Why Investing In Real Estate Is Better Than Investing In Gold?

Investing has always been a popular way to grow wealth and secure financial future. Now, people are constantly seeking avenues to invest their hard-earned money in real estate and gold by considering it’s high return value and long term prospects. While both real estate and gold have their merits, real estate holds a special place in the hearts of Indian investors due to its historical significance, cultural relevance, and potential for long-term returns. Also investing in gold has always been considered auspicious among Indian denizens, do you think it will help you to beat inflation? The answer is straightforward no because...

1: The cost of gold is plummeting high

Unless you are an elite citizen, investing in gold is a tough nut to crack. If we look into the price from 2017 to 2023, it has been on a constant surge. Right now, the gold price is looming at Rs 61,095, and investing in gold may not fulfil the gap of surging inflation.

2: Poor returns

If we compare it closely with real estate, we will understand that the resale price you will receive from selling gold jewellery is not equivalent to the gold rate. The decline is because the jewellers or government pay you for gold rather than making charges. For example, the gold rate is Rs 50,000 for ten grams of gold, assuming you have bought 20 grams of necklace at Rs 110,000, which includes making charges too. And when you go to resale it, the necklace contains 12 grams of gold; hence the returns will be poor.

3: It is vulnerable to theft.

Investing in gold comes with a different set of challenges; one among them is theft. Though to curb the menace, people strive to invest in ETFs or funds; they are not totally secure and vulnerable to cyber fraud.

4: People can’t bank on it when they retire.

Retirement comes with dependence, and gold is not the safest way to live your life fully after retirement. Since gold investment is made once, you can’t resell it and buy it continuously to maintain cash flow. Thus, people are searching other investment options like properties, and buying apartments and flats in Bhubaneswar gives awesome investment prospects.

Which is the best way to curb the uncertainties and beat inflation?

The real estate market in Bhubaneswar is the best way to beat inflation and curb potential uncertainties. The reasons are hereunder.

1: It is expected that property prices will not decline in 2023

Property prices are expected to stay stable in 2023 for at least 12-18 months. It makes it an easy-to-buy option among investors. By considering these facts, more investors prefer buying residential and commercial properties in temple city Bhubaneswar for their long-term goal.

2: The pandemic has further fuelled the demand for the real estate market.

The pandemic is sure to reboot once again, given the hike in the cases, and this is pushing people to buy flats for sale in Patia to protect them against the hefty rents.

3: Implementation of RERA principles

The real estate market has climbed in the last few years due to the implementation of RERA principles. It has ironed out the unfair practices of developers.

4: Effective and speedy redressal of complaints

The effective and speedy redressal of complaints has impeded the housing sector, and people now believe that real estate is worth investing in. The banks are happy to lend loans to let buyers confidently purchase the home.

5: Instant Home Loans

Many banks have launched instant home loan campaigns wherein customers can avail of home loans with discounts on upfront fee, attractive rates of interest, and nil processing charges. It will add convenience and ease to the buyer.

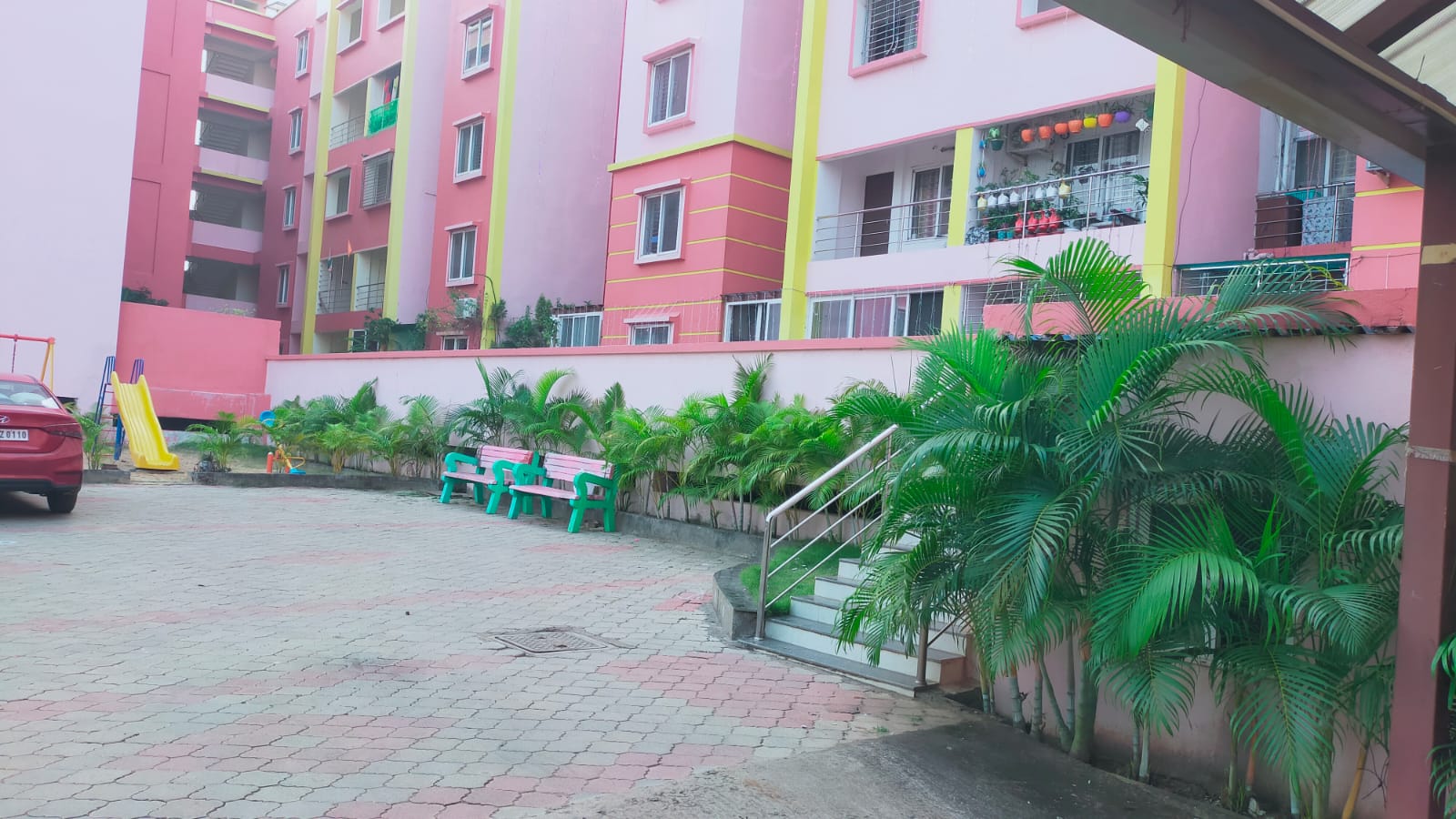

6: A wide array of facilities

Orimark Properties has been catering to the unique lifestyle of its customers for decades. They have strived to go beyond the needs of home buyers and offer flats in Patia at discounted rates. Also, the property comes with an array of conveniences and amenities. This kind of investment opportunity gives buyers a reason to invest in their architecture.

7: It is a safe investment for a better tomorrow

Investing in 3 BHK residential flats in Patia will get a masterpiece crafted by Orimark. In this way, you are investing in a better tomorrow and a unique lifestyle. The apartments in Patia reflect refined taste and have a sense of aesthetics for aspirational buyers. The projects bring a superior lifestyle and world-class facilities.

8: The RBI-regulated sector

RBI has affiliated with the real estate sector and has created a strong governance body to deal with mishaps. It has linked the home loan rates with repo rates, which will help the loan buyers to get the property at a lower interest rate and sell it at a higher price. It is the main benefit of investing in 3 BHK flats in Patia.

9: Higher resale returns

Unlike gold, real estate will fetch you higher returns when you sell, and you can use this investment as an asset for retirement. You can give your property on rent and earn a steady income from it. If approached correctly, real estate investment can deliver high short-term or long-term returns.

Winding it up

Considering the long-term investment, people have their preferences and views regarding investment in gold or real estate. While gold is a highly preferred investment in the Indian household because of its high returns, it is volatile and depends upon the investment he wants. On the other hand, if you buy the property with due diligence, you will not regret your investment; rather, the income will surge, and you will get a higher resale value as expected. You only have to buy the property in Bhubaneswar through a reputed real estate consultant like Orimark Properties. The company provides the investor with a property of choice. They offer you a long-lasting asset with multiple benefits and a legacy that can be passed down to the generations. Contact Orimark Properties to enjoy the finest living amidst the natural landscape.

Popular Content

- Why Premium Flats are the Top Choice for Luxury Living in Bhubaneswar

- Premium Two Bedroom Flats in Bhubaneswar for Modern Families

- Why 3BHK Flats in Bhubaneswar are the Ideal Choice for Modern Families

- Dream Flats in Patia Brings the Future of Urban Living to Life

- Discover Coastal Bliss with Premium Flats in Puri

- Redefining High-End Apartments in Bhubaneswar for a Smarter Lifestyle

- Industrial Land Opportunities in Bhubaneswar for Smart Investors

- Spacious Flats and Apartments Near Khandagiri That Promise Convenience

- Ideal Office Space in Bhubaneswar for Expansion of Your Business

- Smart Warehouse and Godown Buying Guide for Bhubaneswar

- Finding Spacious Flats in Patia: A Guide to Luxury and Premium Living

- Bhubaneswar Rental Commercial Spaces Bring Sustainable Growth

- Complete Guide to 3BHK Flats in Bhubaneswar and Their Blissful Charm

- The Rising Popularity of 2BHK Flats in Bhubaneswar – A Modern Homebuyers Choice

- How Finding Your Perfect Residence near Khandagiri will Give Happiness

- Factors to Consider Before Renting Retail Space in Bhubaneswar

- Create Your Safe Haven of Serenity in Patia: A Beautiful Locale

- How to Find Perfect Office Space in Bhubaneswar for Your Business

- Booking 3 BHK Flats in Bhubaneswar Offers Blissful Living

- Tips to Find the Right Apartment for Sale in Bhubaneswar

- Commercial Properties in Bhubaneswar: Investment Opportunities and Rent Facilities

- Live Large in Bhubaneswar: Discover Luxury Apartments and 3 BHK Flats

- Exploring Real Estate Map of Bhubaneswar with 3 BHK Flats and Luxury Options

- How Luxury Apartments in Bhubaneswar Drive Prosperity with Strategic Investments

- Why Bhubaneswar Should Be Your First Choice for Property Investment in India?

- Bhubaneswar Properties Strategic Advantage: A Confluence of Growth Factors

- Booming Real Estate Market in Bhubaneswar

- Exploring Your Dream Home: Apartments and Flats for Sale in Bhubaneswar

- Navigating the Real Estate Landscape: Finding the Perfect Rental Property in Bhubaneswar

- Discover Your Dream 2 and 3 BHK Flats for Sale in Chandrasekharpur with Modern Amenities

- Discover the Charm of Patia with Luxury Flats and Apartments Buying Opportunities

- Why Investing In Real Estate Is Better Than Investing In Gold?

- Expert Tips for Finding Commercial and Residential Property for Rent in Bhubaneswar

- A Guide to Choose Right 2 BHK or 3 BHK Flats in Bhubaneswar with Orimark Properties

- Importance of Amenities While Buying Flats and Apartments in Bhubaneswar

- Eleven Things to Know Before Renting a Commercial Space in Bhubaneswar

- House Hunting Tips for New Property Buyers in Bhubaneswar

- Six Things to Know Before Selling Property in Bhubaneswar

- What Are The Factors Affecting The Prices of Flats in Sundarpada?

- Essential Things When Looking for Flats in Patia, Bhubaneswar

- 4 Points to Know Before Renting Any Type of Property in Bhubaneswar

- 5 Things to Know While Purchasing Residential Flats in Sundarpada

- 4 Myths You Should Not Follow While Purchasing Residential Flats in Sundarpada

- 3 Benefits of Using A Reputed Realtor While Buying Any Residential Property in Bhubaneshwar

- Key Points to Consider While Renting a Commercial Space in Bhubaneswar

- 5 Best Residential Localities to Live and Settle Down in Bhubaneswar

- Booking Residential Apartments in Patia - Why Is This Idea Always Welcome?

- Why Sundarpada Should Be Your Next Property Buying In The Smart City, Bhubaneswar?

- Why Buying a Residential Property in Sundarpada Will Be Your Best Decision?

- Advantage of Owning an Apartment with Merlin X, Tangra Kolkata

- Green Housing with Eco-Living Technology: The Future of Real Estate

- In 2021 Why Young Families Keen To Stay And Invest in BBSR Properties?

- How Can Recession Affect Commercial Property Business?

- What is the best time to buy your dream home you think?

- The Reason behind the Rising of Intellectual Property Frauds in India

- 30 things to know before buying commercial properties

- Investment on Commercial Property a Second Window for 2021 Entrepreneurs

- Pros and Cons of Leasing Commercial Property in India

- 10 Expert qualities you need to find in your property consultant

- 10 reasons to invest in smart city property

- Technological Impact on Commercial Real Estate

- 5 Majors to Remember Before You Go On a Ready to Move Property

- Advantages and Disadvantages of High Rise Living

- Is it a good choice for buying a resale property?

- Property Pricing Trends in Indian Cities

- 10 things to know: when choosing commercial space for your business

- An ideal Place to Live: Independent Home or Apartment

- The Latest Fad of Theme-based Residential Spaces

- Now your dream home is just a way away

- TATA Steel Bhubaneswar Literary Meet to be held in Jan

- Guidance value of properties

.jpg)

.jpg)